Foreclosure Overages: How Loss Can Lead to Unexpected Recovery

Let's be honest, losing your home to foreclosure feels like rock bottom. You're dealing with the emotional weight of losing a place filled with memories, the stress of finding somewhere new to live, and the crushing feeling that you've lost everything you worked so hard to build.

But what if I told you that your foreclosure story might not be over? What if there's a chance that loss could actually lead to an unexpected financial recovery?

I know it sounds too good to be true, especially when you're in the thick of dealing with foreclosure aftermath. But stick with me here, because what I'm about to share could completely change how you view your situation.

The Hidden Truth About Foreclosure Sales

Here's something most people never learn: when your home gets sold at a foreclosure auction, the bank doesn't automatically get to keep every penny from that sale. They're only entitled to what you actually owed them, plus their costs and fees. Anything above that? That money belongs to you.

These leftover funds are called foreclosure overages, and they're also known as surplus funds or excess proceeds. Think of it this way, if you owed $200,000 on your mortgage and your home sold at auction for $250,000, that extra $50,000 is legally yours to claim.

The crazy part is that millions of dollars in surplus funds go unclaimed every single year, not because people don't deserve the money, but because no one ever told them it existed.

Why Most People Never Know About Their Money

So why doesn't everyone know about this? Well, the system has a pretty big flaw. When surplus funds are available, you're supposed to get notified, but that notice gets sent to your last known address. And guess what that address usually is? The home you just lost to foreclosure.

It's like a cruel joke, right? The very place you can no longer access is where the most important financial information of your life gets delivered.

By the time you realize you might be owed money, months or even years might have passed. Some people discover surplus funds exist only by accident, maybe a friend mentions it, or they stumble across information online. Others never find out at all.

Real Numbers, Real Recovery

Let me paint a picture of what we're talking about here. These aren't just a few hundred dollars we're discussing. Surplus funds can range from thousands to hundreds of thousands of dollars. I've seen cases where families thought they'd lost everything, only to discover they were owed $50,000, $75,000, or even more.

Imagine Sarah, a single mom who lost her home after her ex-husband stopped making mortgage payments during their divorce. She felt defeated, thinking she'd have to start completely over with nothing. Two years later, she discovered that when her house sold at auction, it generated $68,000 in surplus funds that had been sitting unclaimed. That money became her down payment on a new home and gave her the fresh start she desperately needed.

Or consider Robert, a retiree who lost his home due to mounting medical bills. He assumed his equity was gone forever. But when his house sold for significantly more than what he owed, $43,000 in surplus funds were waiting for him. That money helped him secure stable housing and covered some of those overwhelming medical expenses.

These aren't fairy tales, they're real recoveries happening every day across the country.

Understanding the Process

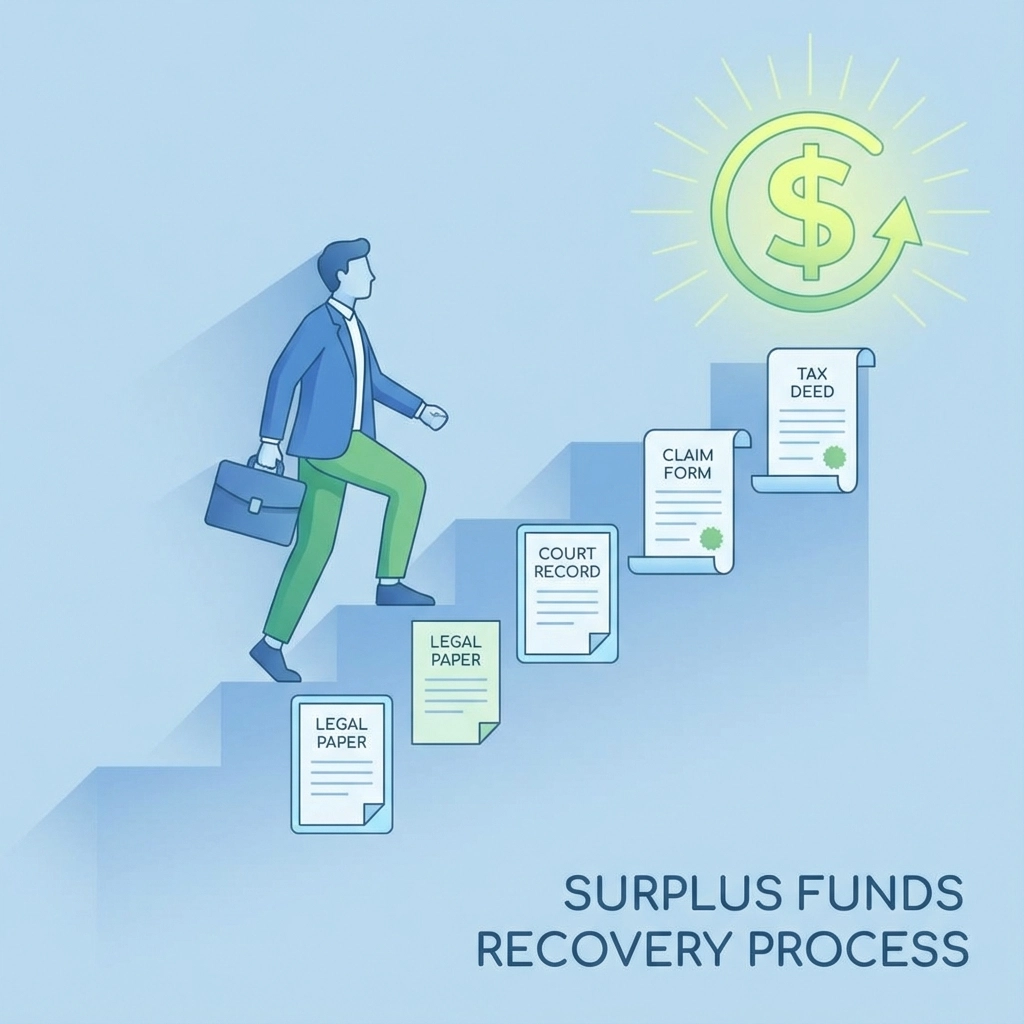

Now, claiming surplus funds isn't always straightforward, and that's where many people get stuck or give up. The process varies by state and county, and it often involves paperwork, deadlines, and sometimes court appearances.

But here's the empowering part: with the right information and guidance, it's absolutely doable. You don't need to be a legal expert or have special connections. You just need to understand what steps to take and when to take them.

The basic process usually involves:

Confirming that surplus funds exist from your foreclosure

Gathering the necessary documents to prove your ownership

Filing the appropriate paperwork within the required timeframe

Following up to ensure your claim is processed

Sounds manageable when you break it down like that, doesn't it?

When to Go It Alone vs. When to Get Help

Some surplus fund recoveries are straightforward, especially when the amounts are smaller and the paperwork is minimal. But other situations can get complex quickly, particularly when there are multiple liens, disputed claims, or significant amounts of money involved.

The key is knowing when you can handle things yourself and when professional help makes sense. It's like doing your own taxes versus hiring an accountant, sometimes the DIY approach works perfectly, and sometimes the stakes are high enough that expert guidance is worth the investment.

Don't Let Scammers Steal Your Hope

Unfortunately, where there's unclaimed money, there are also people trying to take advantage. You might receive letters or calls from companies claiming they can recover surplus funds for you, for a hefty fee, of course.

Here's the truth: you can often handle surplus fund recovery yourself, or work with legitimate professionals who charge reasonable fees and operate transparently. Be wary of anyone demanding large upfront payments or promising guaranteed results.

Your Loss Doesn't Have to Be Final

The most important thing I want you to take away from this is that foreclosure doesn't have to be the end of your financial story. Yes, losing a home is devastating. Yes, it feels like you've lost everything. But the system that took your house might actually owe you money.

That equity you built over the years? It doesn't just disappear because of foreclosure. If your home sold for more than you owed, that difference could be rightfully yours to claim.

Knowledge Is Your Greatest Asset

The foreclosure system can feel overwhelming and unfair, but knowledge is your greatest advantage when dealing with it. Understanding surplus funds, knowing your rights, and learning the proper steps to take can transform what feels like a hopeless situation into an opportunity for recovery.

Don't let confusion or intimidation keep you from exploring whether surplus funds might be waiting for you. With clarity, compassion, and practical guidance, you can turn that confusion into confidence: and potentially turn your loss into recovery.

If your home went through foreclosure, especially in recent years, it's worth investigating whether surplus funds might be available. The worst thing that can happen is you find out there aren't any. But the best thing that could happen? You might discover a financial lifeline when you need it most.

Take the Next Step

Ready to learn more about foreclosure surplus funds and whether you might be entitled to recovery? I've put together "The Ultimate Guide to Foreclosure Surplus Funds": a comprehensive resource that walks you through everything you need to know about this often-overlooked opportunity.

This guide will help you understand the surplus fund process, avoid common pitfalls and scams, and give you the tools to determine if money is waiting for you. Because you deserve to reclaim what's rightfully yours, and this guide shows you exactly how.

Don't let the system keep what belongs to you. Your foreclosure might not be the end of your story( it might just be the beginning of your recovery.)